Products We Offer

Whether you're looking to fund personal expenses, grow your business, or buy your dream home, we have the perfect loan solution for you.

Used Car Refinance

Refinance your used car loan with us and enjoy better rates and flexible terms.

New Car Loan

Drive your dream car today with our competitive rates and flexible repayment options available.

Used Car BT

Save more with our Used Car Balance Transfer, offering lower EMIs and better rates.

Personal Loan

Fulfill your dreams with our hassle-free Personal Loan, designed to meet your needs.

Property Loan

Expand your business fleet with our tailored Commercial Vehicle Loan, designed for growth.

Commercial Vehicle Loan

Get behind the wheel of your dream vehicle with our easy and quick loan approval process.

Frequently Asked Questions

Find answers to the most common questions about our loan services

What type of loan can I get against my car?

You can get a secured loan against your car with competitive interest rates and flexible repayment options.

How much loan can I get against my used car?

You can get up to 80% of your car's current market value depending on the car's age, condition, and model.

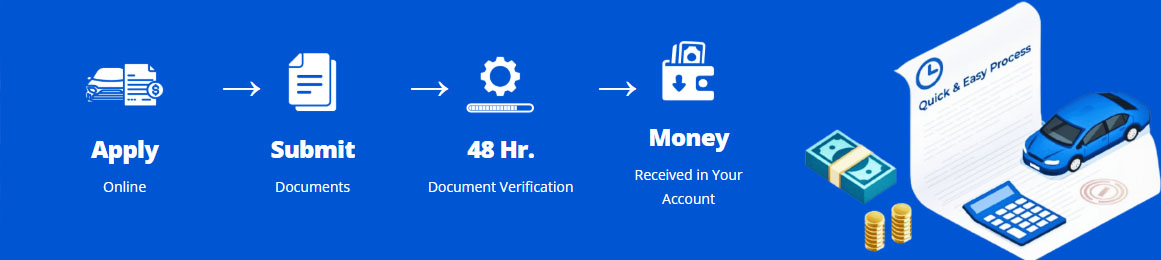

How long does it take to process a loan against a car?

Loan processing typically takes 24-48 hours once all required documents are submitted.

What documents are required to apply for a loan against a car?

You'll need your ID proof, address proof, income documents, car registration certificate, and insurance papers.

Get In Touch With Us

Ready to get started? Contact our loan experts today!

Call Us

+91 6372977626

Mon-Sat: 9AM to 7PM

Email Us

contact@ezyloan.co.in

Quick response guaranteed

Visit Us

1st Floor, Hindustan Tyres Building, Pir Bazar, Bhanpur, Cuttack, Odisha - 753011, India

Head Office Location

Why Choose EzyLoan?

We make borrowing simple, transparent, and hassle-free with our customer-first approach.

Competitive Rates

Industry-leading interest rates starting from 8.99% with transparent pricing.

Quick Processing

Get approved in as little as 24 hours with our streamlined digital process.

Secure & Trusted

Bank-grade security and trusted by over 100,000 satisfied customers.